Contents:

A company can have hundreds or thousands of customers with current accounts receivable balances. The total of all of these accounts is carried forward into the A/R control account, which appears in the general ledger and thefinancial statements. Accounting controls are methods and procedures that prevent, detect, and correct misstatements that occur within the financial accounting process until the formation of the financial statements.

So, if reconciliation/control proves that there is no difference between two balances, it means figures are reliable and can be used to prepare the financial statement. A different person can maintain the control account as a check against fraud. Accounting control systems do not work under one size fits all scenarios. Research on the relationship between business strategies and accounting-based control systems finds organizational design and corporate culture to play a significant role in a business’s success.

Some will use a numbering system; others use the vendor name while others may use a function name such as ‘Rent’ and ‘Insurance’. The period costs account is part of the double entry system and the subsidiary ledgers are for analysis only. With such a large number of debtors, it would clutter the general ledger with 2,500 single accounts. In order to simplify the mess, you can create both a control account and subsidiary ledger for your debtors.

https://1investing.in/ accounts sum up the values related to different functions of the business. Summation accounts are similar but they don’t organize the respective sub-accounts by name or function but organize data based on some GAAP related principle. For example, Fixed Assets sum up the different types of fixed assets; you may have real estate in one subaccount, equipment in another, office technology in another and so on. It is irrelevant who made the items or where they were bought; the key is the type of equipment. This limitation makes it difficult to comply with the segregation of incompatible duties because it’s possible that one or two employees might handle several custody, authorizations, and recording functions. In small business bookkeeping, the owner might only hire one to two accounting staff to record daily transactions, reconcile customer or vendor accounts, or even handle assets.

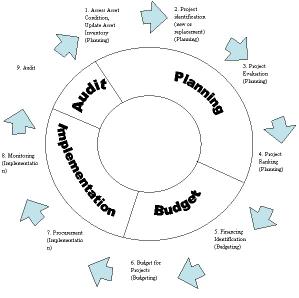

Any time a cash drawer is tallied, or raw material counts are verified, an asset audit is being performed. These on-site audits should be performed regularly to ensure financial accuracy. Counting cash should be done hourly or daily, while physical asset tracking is typically done quarterly or annually. Manually counting assets in this manner is crucial because fraud can occur off the books to bypass financial report audits. Designating managers to be responsible for transaction authorizations is an internal control function that funnels purchase decisions through the most trusted employees. Authorizations may be required for large payments, unusual expenses, and unexpected cost increases.

What Does Control Account Mean?

Companies may have thousands of customers, all with accounts receivable balance. Each of those balances is recorded in a separate A/R subsidiary account. The total for all the accounts is taken and put into the A/R control account. In a typical bookkeeping system where the control accounts form part of the double entry posting, the accounts receivable control account is used for each of these types of transaction as follows. While subsidiary accounts are critical for recording a company’s transactions, control accounts allow for high-level analysis by simply focusing on the balances of each account.

Twitter’s NPR saga demonstrates the challenge of labeling media – Brookings Institution

Twitter’s NPR saga demonstrates the challenge of labeling media.

Posted: Thu, 13 Apr 2023 15:54:36 GMT [source]

As you can see, control accounts drastically clean up the ledger and make it easier for accountants and bookkeepers to use. Trade receivable for the period stands at $10000 in different debtors’ accounts, and trade payable stands at $ in different creditors’ accounts. Internal audits evaluate a company’s internal controls, including its corporate governance and accounting processes. These internal controls can ensure compliance with laws and regulations as well as accurate and timely financial reporting and data collection.

You must cCreate an account to continue watching

They are especially important for reconciliation in large companies with a high volume of transactions when only the balance of the account is needed. Systems, accounts receivable and accounts payable are the most most common types of control accounts. However, some companies may have control accounts for inventory, fixed assets and payroll as well. However, errors and fraud can still exist in a double-entry accounting system, which is why trial balances should be used in conjunction with this method. Trial balances are a form of accounting control that infuse additional reliability into the system by keeping an internal record of credits and debits to allow businesses to identify issues early on.

The total of discount received for the month, amounting to $1,715, has not been entered in the control account but has been entered in the individual ledger accounts. Traditionally bookkeepers or other accounts personnel perform areconciliationon a regular basis between the control accounts and the total of the debtors or creditors ledger. For debtors, we compare the closing balance of the debtors control account in the general ledger to the total of all the closing balances of the individual debtor accounts in the debtors ledger. Entries in the control accounts such as “total sales”, “total purchases” as well as “bank” come from the relevantaccounting journals. The reason these accounts are calledcontrol accountsis because one uses them to ensure there are no errors or mistakes in our records relating to debtors and creditors.

What Are Control Accounts?

The correct double entry has been posted but theindividual accounts have not been updated. Remember, the control account is normally part of the double entry system, whereas the ledger contains memorandum accounts which are not part of the double entry system. Nevertheless, both are updated using the same sources and therefore should agree. Control accounts are General Ledger accounts accessed from Oracle Payables, Receivables. The control account segment qualifier lets you indicate which account segment values represent control accounts. You must define the control account segment qualifier before you can define accounting segments values as control accounts.

- Smaller companies may be able to rely on control accounts if they remain balanced using double-entry accounting.

- It’s a mistake to assume that internal controls are only for huge corporations or multi-national companies.

- If you need to view a specific transaction, you would need to access the appropriate subsidiary ledger in order to view the details.

- The U.S. Congress passed the Sarbanes-Oxley Act of 2002 to protect investors from the possibility of fraudulent accounting activities by corporations.

- If you’re using a manual accounting system, there are benefits to using control accounts.

In 2020, a year-long audit by the State of Alabama concluded with the conviction of two middle school employees who had used school funds to make personal purchases. A risk assessment is the first step in creating internal controls and involves determining the threats facing your company and the extent to which they impact your operations and revenue. Throughout a risk assessment, you’ll identify stakeholders, assess current vulnerabilities and outline mitigation strategies to counteract the key business threats. However, many accounting software options can automate many of the monotonous, mind-numbing aspects of internal control measures so managers and directors can focus on the areas that drive the company forward.

A common example of a control account is the general ledger account entitled Accounts Receivable. Standardizing financial documents creates consistency, which makes it easier during the auditing process. While some reports like a balance sheet or P&L statement have a standard format, other documents can vary substantially between business teams. Creating and using the same templates for estimates, invoices, purchase orders, funding requests, receipts, and expense reports creates comparability across like items during an audit. Streamlining these items is an important internal accounting control that businesses tend to overlook in the rush to implement more obvious control systems. The best way to approach the question is to consider each of thepoints above in turn and ask to what extent they affect the payablesledger control account and the listing of payables ledgerbalances.

More newsrooms bail on Twitter as Musk meddles with account labels – TechCrunch

More newsrooms bail on Twitter as Musk meddles with account labels.

Posted: Thu, 13 Apr 2023 18:20:50 GMT [source]

They’re also a means of double checking accounts, to make sure no mistakes have occurred. Business leaders understand it is essential to have accurate financial data to drive operations and measure success. However, without the proper controls in place errors, fraud, and other issues can occur, hindering operational efficiency and growth. While some small business owners assume internal control systems are only designed for larger organizations, these functions are crucial for companies of all sizes in all industries. Detective internal controls attempt to find problems within a company’s processes once they have occurred. They may be employed in accordance with many different goals, such as quality control, fraud prevention, and legal compliance.

If you have a very small business, you really don’t need to use a control account. However, if you have numerous transactions that are processed on a daily basis and you’re not using accounting software, using control accounts can help manage those transactions while also guarding against fraud. Thegeneral ledgercan have hundreds of accounts from asset and liability accounts to income and expense accounts.

In the accounting cycle, the first step is posting entries in the books of accounts. Once different accounting entries are posted in the books, different ledgers are created that help to set structured and complied data related to different business operations. The information posted to the accounts payable control account and the source of that information are shown in the table below. If the trial balance does not balance, only the accounts whose control account does not reconcile need to be checked for errors. When a customer makes a payment for an outstanding invoice either a check will be received or if paid directly to the bank account, an entry will appear on the bank statement of the business. The check and the bank statement are both source documents in relation to the cash receipt transaction.

The balance on the accounts receivable control account at any time reflects the amount outstanding and due to the business by customers for credit sales. A control account integrates and summarizes a particular type of subsidiary account. Einstein utilizes purchases and payable control accounts to record his business transaction.

In the case of an accounts receivable control account, the subtotal of the customer balances in the subledger must match up to the control account. If it does not, then there is an error somewhere in the books that must be corrected. Those subledgers are totaled for each reporting period, and the totals make up the balance of the accounts receivable control account. In other words, the accounts receivable control account reflects the total amount that a company is owed, while the its subledger shows how much each individual customer owes.

- Accounts payable and accounts receivable control accounts are the most frequently used control accounts, although inventory and fixed asset control accounts can also be used.

- Check your understanding of this lesson by taking the quiz in the Test Yourself!

- If every single account was included in the general ledger, it would be very large, unorganized, and difficult to use.

- Find out how GoCardless can help you with Ad hoc payments or recurring payments.

Following several high profile corporate accounting scandals at Enron, Tyco, and WorldCom, from 2000 to 2002, regulators wanted to usher in a new era of heightened financial and operational protocols. To restore investor trust, it was widely accepted that a new culture was required. The Sarbanes-Oxley Act is a piece of regulation drafted to ensure financial reporting avoids any fraudulent activity. Is used for suspicious entries in financials that are not identified when preparing financial accounts.. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Read our editorial process to learn more about how we fact-check and keep our content accurate, reliable, and trustworthy.

He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. It should be noted that cash purchases are not included in this procedure. Review financial reports and activity logs to ensure procedures are being properly followed. There are three major types of CA – Preventive control activities, Detective control activities, and Corrective control activities.

A different person can maintain the control account as a preventive measure against fraud. Discounts allowed totalling $120 have not been entered in the control account. Next up, we’re going to tackle the penultimate step in the accounting cycle – the trial balance. Credit purchases interfere with the credit balances brought down that are to be paid later to the supplier for the delivered commodities. Payroll Liabilities – when employees are paid, this account sums up the various tax liabilities, garnishments, accrued time off in dollars, third party payments due, accrued retirement etc. An auditor is a person authorized to review and verify the accuracy of business records and ensure compliance with tax laws.